Breadcrumb

Infrastructure Investor Bulletin January 2023

News, updates and events from the infrastructure investor industry

Sign up here to Receive our monthly Newsletter

CEO Update

Thank you for the many kind messages received on news of my appointment, it is much appreciated. I hope 2023 has got off to a good start for you, it’s certainly been a whirlwind start to the year for the GIIA team.

In January we have already welcomed four new members, co-hosted an Investor Roundtable in Washington DC, launched a set of recommendations on energy policy in Brussels, hosted an Investor Roundtable with the UK Infrastructure Bank in London, given evidence before the House of Commons International Trade Select Committee on investment protection and dispute settlement, held the first Tax working group meeting of the year and the first of two workshops on Biodiversity in partnership with UNPRI.

For those that were able to join our All Member Call last week or have subsequently glanced through the information pack we have circulated, I hope you have sensed the excitement and ambition that underpins our plans for the year ahead. In all key markets there is much to be done to help shape future policy and economic regulation at a time when cost of living pressures contrast with the need for a manifold increase in investment to address resilience and net zero challenges. GIIA aims to be at the heart of those discussions whilst also bringing market insights and thought leadership to our members and stakeholders through our programme of research, reports and events throughout the year.

Investor members will shortly receive a request to help us compile data to support our Global Asset Database, a fundamental component of our research activity which underpins our global advocacy programme. Please help us by providing a timely and comprehensive response.

As ever, please keep an eye on your inboxes, our website and social media for more details about how to get involved in our working groups and other activities. I look forward to seeing many of you in Berlin for the return of our reception kindly hosted by Allianz – a real highlight for those who are attending the conference.

GIIA Announces New Members

Strategic regulatory advisory firm

Provider of research, data and technology services to global investment community

Strategic communications consultancy

Global leader in real assets data, research and intelligence.

As GIIA’s market data partner, Realfin is offering a 25% discount on access to the RealfinX Platform for GIIA members that are new to Realfin’s data services contact info@giia.net.

GIIA Latest News

Global investors urge EU to "get the fundamentals right" in response to Inflation Reduction Act

With the European Commission forecasting that €210bn of investment will be needed to keep RePowerEU targets on track in the years to 2027, the latest major GIIA EU policy report emphasises the need for:

- Accelerated permitting reform

- Reliable, stable regulation

- Promoting strong project pipelines

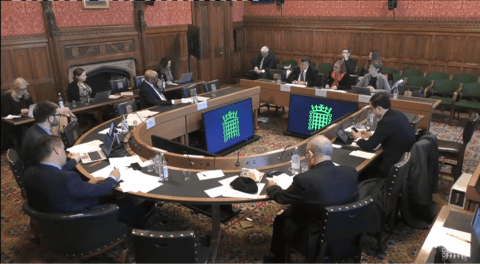

GIIA Evidence to International Trade Select Committee

Speaking to the UK parliament's cross-party International Trade Select Committee last week, our Chief Executive Jon Phillips flagged the importance of global protections for infrastructure funds that invest on behalf of pension savers around the world.

Podcast: Geopolitical Dynamics & 2023 Outlook

In episode 7 of Talking Global Infrastructure Geopolitical Dynamics & 2023 Outlook, Acting CEO Jon Phillips is joined by Deloitte's Patricia Buckley and Ian Stewart, where talking points include; how worldwide infrastructure policy shifts are shaping the year ahead for investors, ongoing supply chain challenges following the pandemic and how the global economy is changing to pave the way for sustainable growth.

Policy Spotlight

USA

After a prolonged voting process, Rep. Kevin McCarthy (R-CA) was elected Speaker of the House of Representatives. Hakeem Jeffries (D-NY) was named Democratic Leader replacing long-time leader Nancy Pelosi (D-CA). Republicans hold a four-seat majority in the House of Representatives, which gives considerable clout to the party’s most conservative members. Representative Sam Graves (R-MO) will chair the House Transportation and Infrastructure Committee. Graves legislative priorities include reauthorization of the Federal Aviation Administration and aviation programs, oversight of the Infrastructure Investment and Jobs Act, and legislation to alleviate ongoing energy and supply chain issues.

Gabe Klein, the executive director of the Joint Office of Energy and Transportation, said that the Department of Transportation will soon issue minimum standards and a “Buy American” waiver for the $5 billion electric vehicle charging grant program. The final rule is expected to address questions such as how charging stations will accept payment and whether the chargers will have screens, while also providing states with flexibility to address the needs of rural versus urban areas.

GIIA teamed with the Milken Institute to host the first Infrastructure Investor Roundtable during the Institute’s Public Finance Forum in January. The Roundtable included both large and small investor institutions including several GIIA member companies, along with advocates for climate resiliency, and greater diversity and equity for underserved populations and regions. Key topics included the energy transition, access to broadband, and the role of permitting in major infrastructure projects.

GIIA’s US Policy Working Group gathers for its first meeting of 2023 on 9 February in D.C., ahead of the NGA’s Winter Meeting. If you would like to join us, in person or online, please let us know.

David Quam, GIIA Washington Representative

UK

The New Year has seen the publication of ‘Mission Zero’ – the eagerly awaited set of findings from the Independent Review of Net Zero led by Chris Skidmore. GIIA welcomed a number of aspects highlighted by the Report, including calls for action on the ’25 key actions for 25’. These included recommendations for a new forum to coordinate across all regulators, as well as for HMT to review how policy incentivises investment in decarbonisation.

As manifesto development begins to take shape, GIIA has started work on a ‘White Paper for Investment’. The report will deliver a set of manifesto style regulatory and policy recommendations, that can be drawn on by UK political parties in the lead-up to Conference season. We would encourage members to reach out at the earliest opportunity to engage and share their input.

Recent engagement with the UK Infrastructure Bank provided attendees with an update on their Strategic Plan and advisory role for local authorities as well as an opportunity to unpack possible sector specific opportunities.

In coming weeks, we look forward to an in-person meeting with the new Minister for Investment. This will provide a key opportunity for GIIA to raise ongoing key concerns, including the Electricity Generator Levy (EGL), which a number of members have highlighted places renewable investors at a disadvantage. Additionally, the onerous requirements stipulated in the Foreign Influence Registration Scheme (FIRS), that we argue could deter positive and mutually beneficial exchanges between investors and policymakers. Crucially, the scheme is broader in both definition and scope than either the Australian FITS or US FARA counterparts.

I recently had the pleasure of joining Viridor’s recycling infrastructure roundtable discussion, which considered a range of important issues relating to the circular economy, including barriers to investment and policy reform. It was also fantastic to attend the Social Contract Summit hosted by Indepen and the Water Report and hear from expert policy and regulation panels on taking a “whole systems approach”, with a particular focus on the water sector. Each of these discussions recognised the scale of the challenge ahead, and that collective action must be taken to help deliver on the UK’s objectives.

With a busy agenda lined up for the year, I look forward to engaging with you during our series of UK Policy Working Groups. We are always delighted to hear from members, so please do reach out with any policy concerns and suggested agenda items for discussion.

Chloe Gibbs, Policy & Public Affairs Manager

Europe

It's been a busy start to the year in Brussels, as the EU seeks to build greater energy security, complete the energy transition and move the decarbonisation of transport agenda forward. However, a threat looms large over the Berlaymont and the capitals of EU member states in the form of the Inflation Reduction Act that risks the EU's competitiveness to retain and attract new private capital to fulfil its goals and maintain Europe's place as the home for innovation across new and emerging industries.

After the EU was caught off-guard by last year's US Inflation Reduction Act, the Commission's Margrethe Vestager laid out proposals this month in a speech at the Cleantech for Europe Summit, for how the EU should respond through a mix of changes to state aid rules and tax breaks at the member state level, as well as the creation of a possible new Sovereignty Fund. Concern remains however, on how to protect the integrity of the Single Market, with Vestager stressing that the EU's long-term competitiveness will not be built on subsidies. We're expecting more on this in the coming weeks as the EU seeks to retain and attract more investment to meet the demands of the European Green Deal.

In a timely development, we launched our energy paper; Powering the clean energy transition in the EU at a roundtable event at the end of January. The roundtable included investors and advisory members, the EU Commission and industry representatives. The paper was also picked up by Politico Europe and shared widely across social media channels, giving us excellent reach as we embark on a supporting engagement programme to drive the recommendations in the paper forward in support of the EU's desire to attract increasing levels of private infrastructure investment.

Members with existing or planned EU energy assets should be aware of the EU's electricity market design consultation which closes on 13 February ahead of Commission proposals coming forward in March. The consultation looks at the expansion in use of CfDs and PPAs as a way of buffering consumers against price rises in short-term markets, as well as seeking views on the extension of the inframarginal price cap beyond June. We're currently preparing a submission and welcome input from the membership as we draft our response.

On transport, we recently met with a Commission delegation from DG MOVE to discuss the progress of Fitfor55, the taxonomy and funding, as well as developments across modalities from airports to rail. During the meeting the head of the Transport Investment Unit, Philippe Chantraine, stressed the desire for more investors to utilise AFIF to support the deployment of alternative fuel infrastructure. A fuller update on our discussions will feature on our next EU Working Group call.

Harvey Chandler, Senior Policy & Public Affairs Manager