Breadcrumb

Key biodiversity considerations for infrastructure investors

We take an in-depth look at learnings from the two roundtables that we held with Principles for Responsible Investment earlier this year, attended by more than 200 participants

Why biodiversity considerations matter

The discussion started by looking at why infrastructure investors should integrate biodiversity considerations into their investments, and the risks of not doing so.

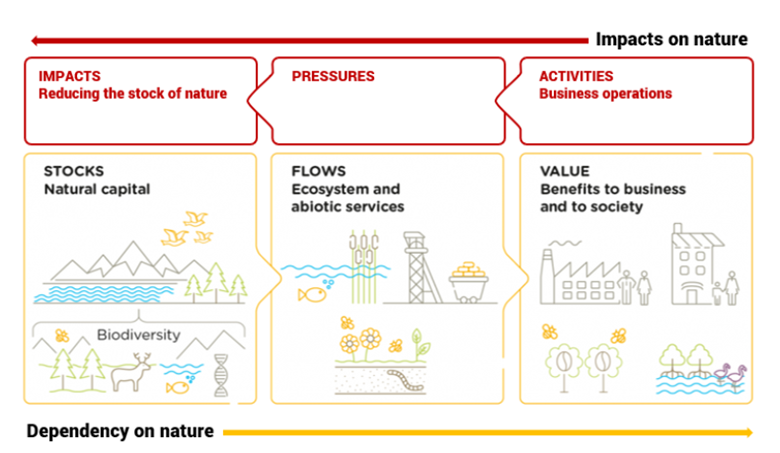

Participants discussed the ecosystem services and value that nature provides our economies and societies[1] (see Figure 1) and how this applies to infrastructure, citing examples such as the mangroves which protect coastal infrastructure from floods and storms, the loss of which creates a physical risk.

They also acknowledged that infrastructure is closely linked to the drivers of biodiversity loss, such as land and sea-use change, overexploitation of natural resources, pollution, climate change, and invasive species.[2]

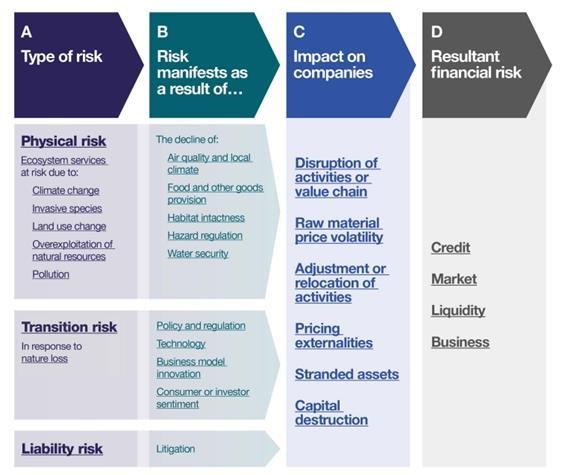

Infrastructure investors are also likely to face a range of risks (see Figure 2), including transition risks that may lead to stranded assets, as policy makers, businesses and consumers look to address environmental change. For example, the EU Biodiversity Strategy has set a 30% minimum target for land to be protected, which could mean that current or future infrastructure may overlap with protected areas, and therefore face higher scrutiny and potential reputational risk.

It was noted that transition risks are likely to accelerate in the near term, given that the Kunming-Montreal Global Biodiversity Framework (likened to the Paris Agreement) was adopted by 196 countries at the UN Biodiversity Conference COP15 in December 2022. Governments are now expected to translate the framework into national plans and policies over the next two years, with an overarching target to halt and reverse biodiversity loss by 2030.

Finally, the group also touched on how biodiversity-related risks can contribute to systemic risk – the risk that the entire financial system collapses because of contagion from localised losses and institutional failures.

Getting started: climate and biodiversity are deeply interlinked

Given the close links between infrastructure assets and the environment, many infrastructure investors already consider biodiversity in their processes. Participants expressed concern about being able to go further with this while needing to better integrate broader climate considerations.

Nonetheless, there was consensus that:

-

the infrastructure sector already has well-established and robust practices to mitigate negative impacts on nature;

-

given the deep links between climate and biodiversity, many existing practices can be extended or adapted to incorporate biodiversity considerations.

For example, the International Finance Corporation’s (IFC) Performance Standard 6, which focuses on protecting and conserving biodiversity, maintaining ecosystem services, and managing living natural resources, is recognised as a global standard. It has been adopted by Equator Principles signatories, among others.

One investor highlighted that it already tracks certain outcomes linked to the COP15 agreement, such as targets for protected areas and restoration. On greenfield projects, where it tends to work with governments, the investor integrates biodiversity considerations into the design of many assets – by tracking regulatory changes to integrate them in proposals and responses to tenders, for example. It analyses sector-level materiality and integrates relevant biodiversity considerations into ESG action plans for most assets. It plans to extend its materiality analysis and biodiversity-related targets at an asset level.

Another investor, focused largely on European brownfield projects, said it takes a double materiality approach, identifying the potential impacts and dependencies of its investments. On dependencies, it extends the definition of biodiversity to include resources and raw materials, such as water, wood, metal, and minerals. These are considered alongside climate and social issues in a broader set of sustainability risk analyses. On impacts, it identifies and seeks to mitigate or suppress them altogether where possible, examining the current or past policies and actions that companies or projects have implemented that may not align to its current standards.

Participants noted that this can often be the case with infrastructure developed before 2011, when the European Union’s Environmental Impact Assessment Directive was issued, and that investment committees can struggle to determine whether to make such investments.

Another investor has signed the Global Canopy-led initiative to eliminate commodity-driven deforestation from its portfolio by 2025. To meet this goal, it applies the supply-chain mapping approach used for other ESG issues to measure its exposure to commodities whose production drive the majority of deforestation – beef, soy, palm oil, timber, pulp and paper.

Participants highlighted that infrastructure assets can have positive and negative environmental impacts – for example, linear infrastructure such as railway tracks, which have a high impact on biodiversity, are needed to reduce overall emissions from the transport sector.

Investors need to weigh these up on a case-by-case basis to determine whether it is necessary to prioritise a particular outcome or sustainability goal over biodiversity considerations, and if so, continue to mitigate negative impacts where unavoidable. In some jurisdictions, investors may receive regulatory exemptions to proceed with projects if they can demonstrate that those projects make a significant contribution to certain sustainability outcomes despite having a negative impact on protected species.

By the end of the discussion, participants agreed that infrastructure investors can take the following steps to start integrating biodiversity considerations into their investments:

-

Assess exposure to nature-related risks (e.g., direct project and supply chain impacts, dependencies)

-

Seek appropriate ongoing disclosures from investees on nature-related risks

-

Build awareness of the business case internally

-

Assign responsibility for nature-related risks at board level, as is common practice with climate-related risks

-

Set clear and appropriate targets to drive change and ensure accountability

-

Set criteria to support investment in no net loss/net gain infrastructure projects

-

Start developing a pipeline of projects and investments which fully account for biodiversity-related risks and opportunities

Data: challenges and solutions

Despite the overlap between biodiversity and other sustainability factors, participants agreed that it is important to take a thematic approach to data, particularly as a universally accepted set of metrics do not yet exist, despite industry efforts – for example, by the TNFD, the SBTN, and service providers (see Metrics in use: Mean species abundance below) – to develop these.

Participants suggested that investors can take the following steps to address the biodiversity data challenges they face:

-

Identify the impacts and dependencies most material to a particular asset, considering aspects such as geographic location

-

Determine what metrics can be used to define those impacts and dependencies

-

Find the relevant data sources for those metrics

Participants also discussed some data tools that investors can use for screening or to inform in-depth due diligence:

- Exploring Natural Capital Opportunities, Risks and Exposure (ENCORE) provides a high-level materiality view of impacts and dependencies by industry and sector. Some investors also use it to inform their regulatory reporting.

- Integrated Biodiversity Assessment Tool (IBAT) identifies concrete impacts in specific locations. This and other tools can be used to identify whether a project is on or near a biodiversity-rich or protected area.

- natcap is developing tools that can measure the potential impact an investment can have; its proximity to threatened species, and the habitat conditions for any given location.

- CDC Biodiversité is working on a Global Biodiversity Score, a tool which seeks to quantify a company’s biodiversity footprint (similar to a carbon footprint). Data is only available for listed companies but will be expanded to cover real assets in future.

- The TNFD Data Catalyst programme has compiled a list of over 100 data tools that allow investors to see what options exist in the market.

Unlocking value by integrating biodiversity

Considering biodiversity in infrastructure investments, whether through risk management, the use of biodiversity offsets, or new products linked to changing regulations and consumer preferences, can create opportunities, and can help projects or assets that have nature-related risks make a positive contribution to biodiversity instead.

Participants highlighted a project involving wind power infrastructure in sub-Saharan Africa. The original biodiversity impact assessment had missed that the proposed site was important to a critically endangered vulture species. There had been conflict with local stakeholders and national conservation organisations over this, with further studies and stakeholder engagement needed to develop a credible plan to mitigate and offset the environmental risks identified. This resulted in additional costs and a delay in completing the financing for the deal.

The subsequent mitigation plan established a “shutdown on demand” scheme, whereby a team of thirty observers keep watch for vultures and shut the turbines down when there is a collision risk. Not only has this unlocked value by allowing the project to be completed – it has also become a source of employment for the local community. Power generation losses from these shutdowns are miniscule compared to overall production and losses from engineering issues. The project also supports other conservation activities to reduce human-vulture conflict in the area.

Discussing nature-based solutions (e.g., carbon offsets), participants highlighted that these can increase in value if they have biodiversity-related co-benefits. For example, green roofs on urban assets that can simultaneously sequester carbon and provide a new habitat for plants and animals.

Assets can also generate increased revenues in this way – for example, a solar site that delivers local stakeholder benefits to farmers, such as providing land in between the solar panels to grow crops and graze animals, could receive higher tariffs.

Furthermore, it was noted that building a good reputation around nature and biodiversity can enhance brand value and help investors to maintain their social license to operate by unlocking value for local communities, while also addressing climate change, and protecting/restoring natural capital. This is particularly important given that infrastructure projects frequently run into permitting problems and delays over conflicts with local communities over access to natural resources.

Defining terms: Building a common understanding of biodiversity

The roundtables also focused on the terminology used to discuss biodiversity considerations.

Some participants objected to certain investments or projects being described as “nature positive”. Given that there is no consensus on how to accurately measure an investment’s impact on biodiversity, they argued that “contribution” or “no net loss/net gain” may be more appropriate terms to use when addressing the topic.

The discussion emphasised that the focus should be on measuring harm, as this is what creates the risk of regulatory breaches, fines, negative public perception, and brand value loss. Drawing comparisons to climate-related considerations, participants argued that getting the right data, developing KPIs and monitoring them is crucial as this allows investors to devise strategies to mitigate impact where possible or offset it where it cannot be mitigated.

Investors also debated how a “protected area” is defined, something that may be relatively straightforward to do in relation to land but extremely difficult in relation to seas and oceans. Participants called on governments and policy makers to standardise the definition to ensure there is a common understanding of what a protected area is, what is allowed and prohibited within its perimeter, how this is enforced, and how accountability is ensured.

They also highlighted the importance of collaboration between infrastructure investors – by engaging in collaborative initiatives[4], infrastructure investors can contribute to policy consultations and standard-setting discussions on how such important terms are defined.

References

[1] For example, the World Economic Forum has estimated that around US$44 trillion of economic value generation is moderately or highly dependent on nature. See WEF (2020) Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy.

[2] For example, deforestation rates stemming from land-use change and overexploitation of natural resources was estimated at 10 million hectares per year between 2015 and 2020. See WWF (2022) Living Planet Report 2022 – Building a nature-positive society.

[3] Global Canopy (2021) France’s Article 29: biodiversity disclosure requirements sign of what’s to come

[4] All investor activity undertaken through collaborative engagements should be done in keeping with relevant laws and regulations.

This article originally appeared on the PRI website.