Breadcrumb

The IRA one year on: a tale of two sectors?

Our Research Manager Vlad Benn deep dives into which industries are benefitting most from US Inflation Reduction Act

Green incentives contained in the monumental Inflation Reduction Act, signed into law just over a year ago, have been in place for nine months and are helping to spur huge levels of investment into clean energy.

A closer examination of the US’ solar, wind, hydrogen, battery storage and carbon capture sectors, however, tells an interesting story about how that investment is spread.

Whilst the impact on solar and wind power is already clear to see, on other key net zero industries it is decidedly less so.

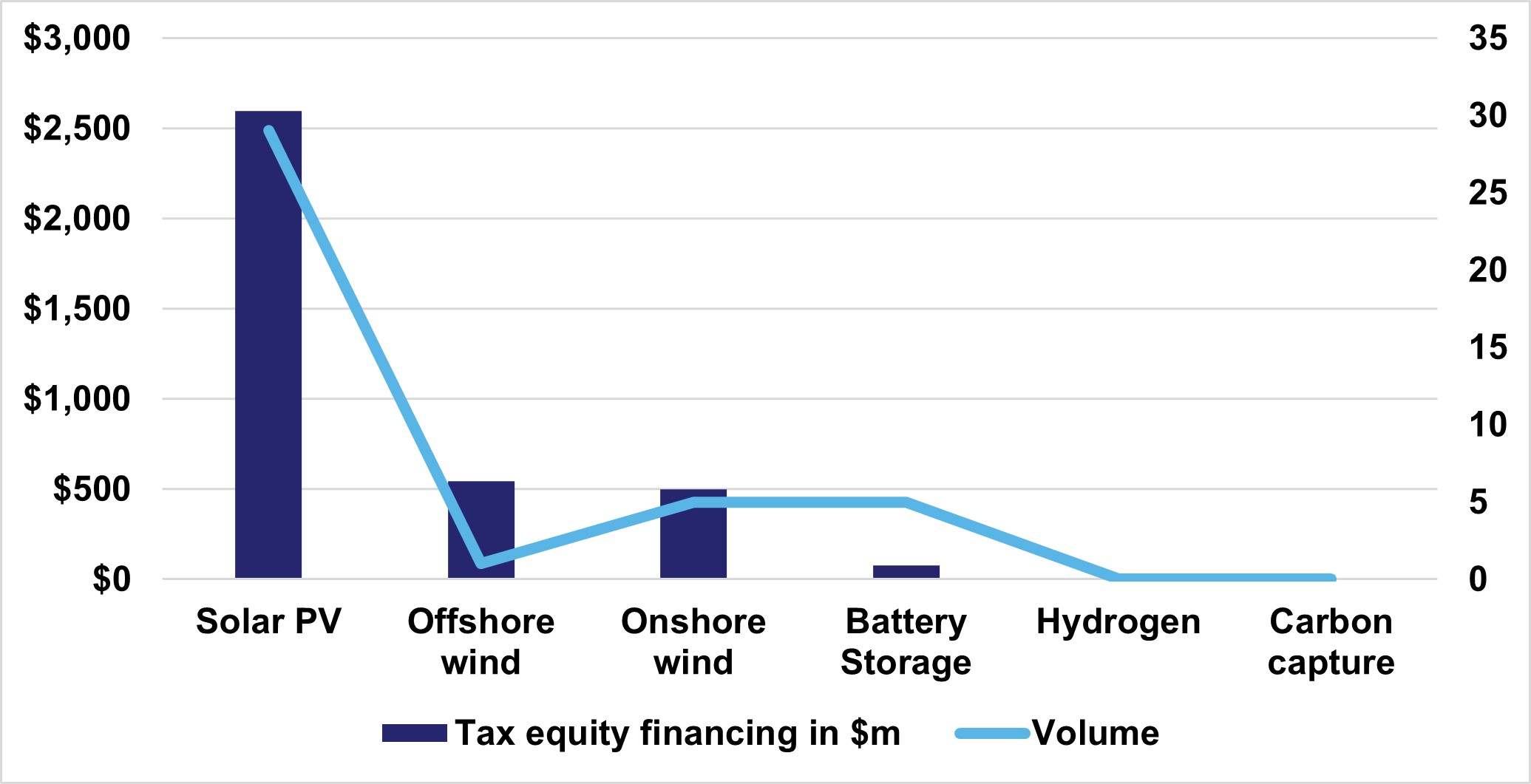

A tale of two sectors? Investments benefitting from IRA incentives in Jan 2023 have been concentrated in solar and wind power:

US solar energy has witnessed a surge in investment, with Q1 of 2023 marked as the most successful first quarter in the sector’s history.

As of Aug 2023, the US has $21bn worth of investment into 86 greenfield projects, equating to a project pipeline capacity of over 13GW.

Though the figures are encouraging, they come at a challenging time, with delivery costs and borrowing rates surging since the IRA was enacted.

Bottlenecks with regards to solar delivery are also a risk, not least because of the IRA’s domestic production requirements, which stipulate that photovoltaic cells must be made in the US to receive support.

With cell production an underdeveloped industry in the US, incentives will be hard to leverage.

Where wind is concerned, offshore projects have received around $500m of tax equity financing since January 2023, and recent auctions in the Gulf of Mexico have been underwhelming, with just one bid received.

In an already difficult delivery environment, the Gulf presents its own unique challenges, not least low energy prices, below average winds speeds and hurricane risk.

Bloomberg NEF states companies overseeing 9.7GW of capacity may need to renegotiate or cancel their power purchase agreements with utility companies over rising construction costs.

And though the US does have a 15GW offshore wind greenfield pipeline, all closed greenfield projects have been onshore.

In the EU, where 27 member countries are being urged to get behind the new Green Deal Industrial Plan, the EU wind pipeline is roughly ten times greater, sitting at 124GW.

These are, of course, still early days for long-term investors who could stand to benefit from the Inflation Reduction Act.

Indeed, when we look ahead in an emerging sector such as hydrogen, the US pipeline is growing rapidly.

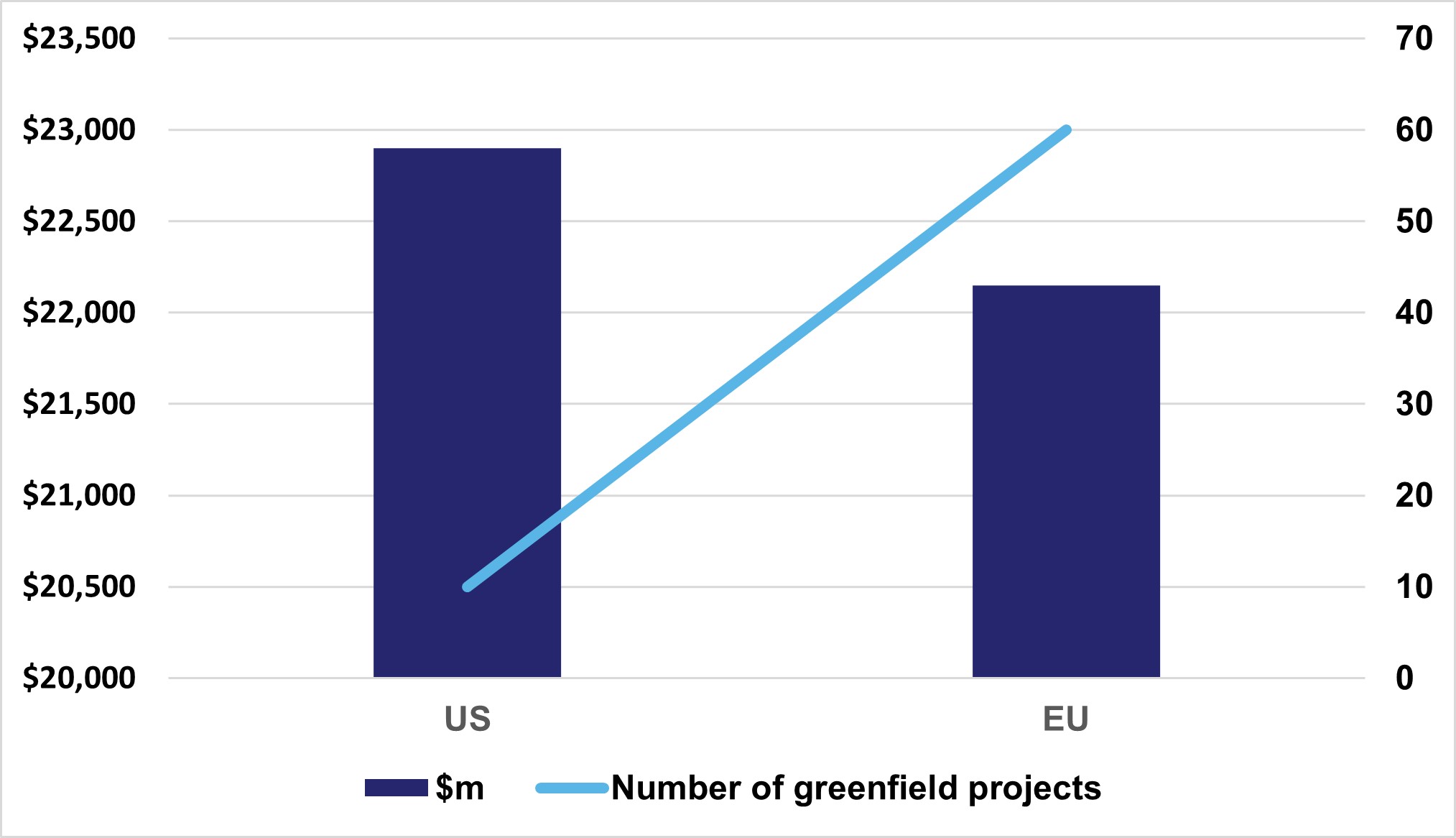

The US’ total hydrogen project pipeline value surpasses that of the EU, though the European bloc holds its own when it comes to volume of projects:

Again, delivery challenges exist, and building and operating hydrogen projects is a complex business. Accessing the relevant tax credits is a challenge too due to limited guidance.

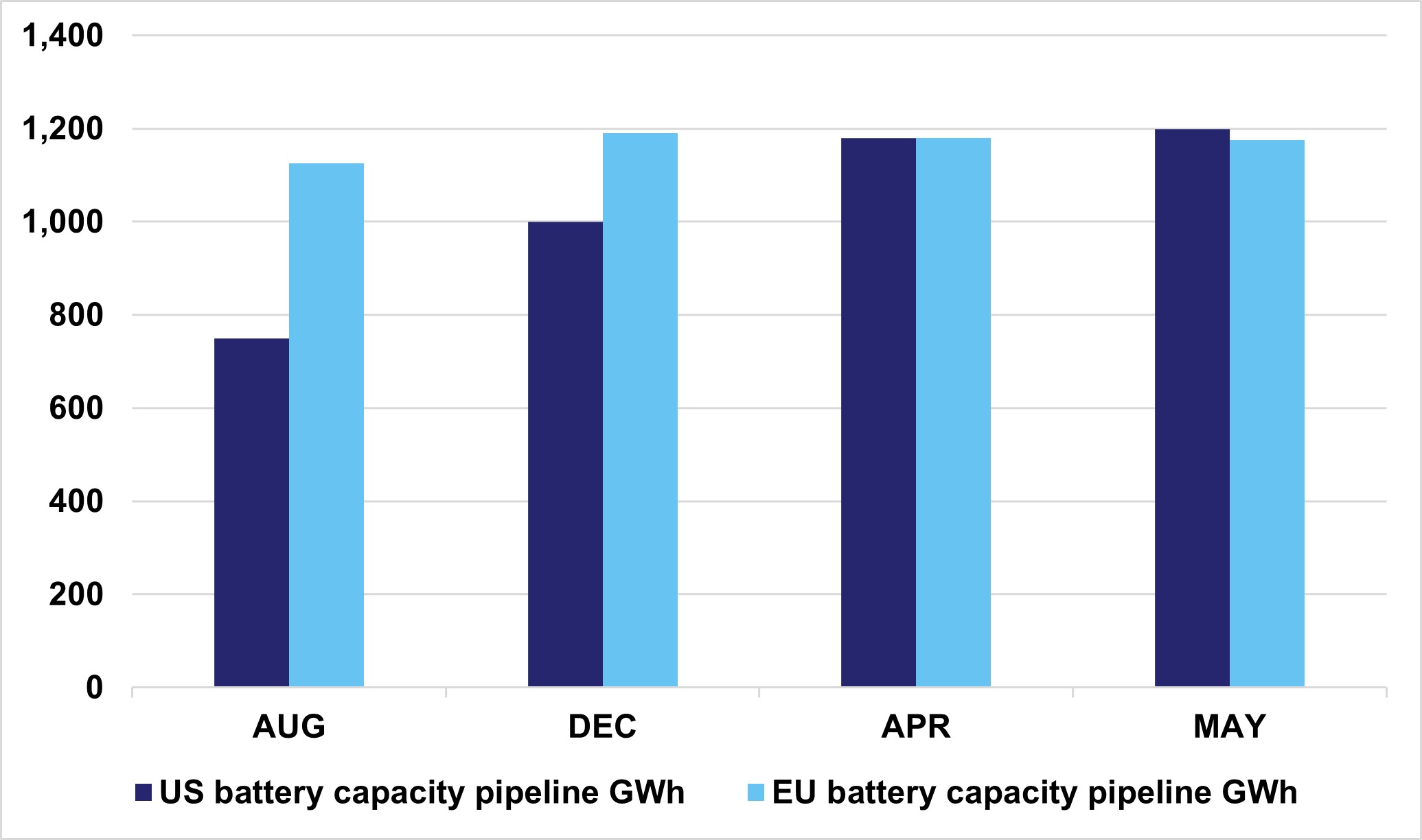

In other nascent net zero tech areas such as battery storage, the US’ capacity pipeline overtook the EU’s in the months following the IRA’s imposition.

Transatlantic battery capacity pipeline growth August 2022 – May 2023 (Adapted from Benchmark’s Gigafactory Assessment June 2023):

By contrast, the US carbon capture industry remains in its early stages. This stands in contrast to the UK which boasts a pipeline worth over $8bn.

With the catalytic foundations of the Inflation Reduction Act have now laid, US departments face the substantial task of turning legislation into action.

The IRA has already had a huge impact in certain sectors. To broaden it’s reach, investors need to see greater guidance around how incentives and credits can be accessed.

With the US setting out ambitious emissions reduction targets in the years to 2030, time is of the essence.