Breadcrumb

Insight from Q4 2023 Pulse Survey: Investor focus and strategies being followed

Our latest pulse survey provides insights into investor sentiments about different markets, offers a window into investment strategies and capital deployment patterns, and explores primary ESG considerations during the investment process

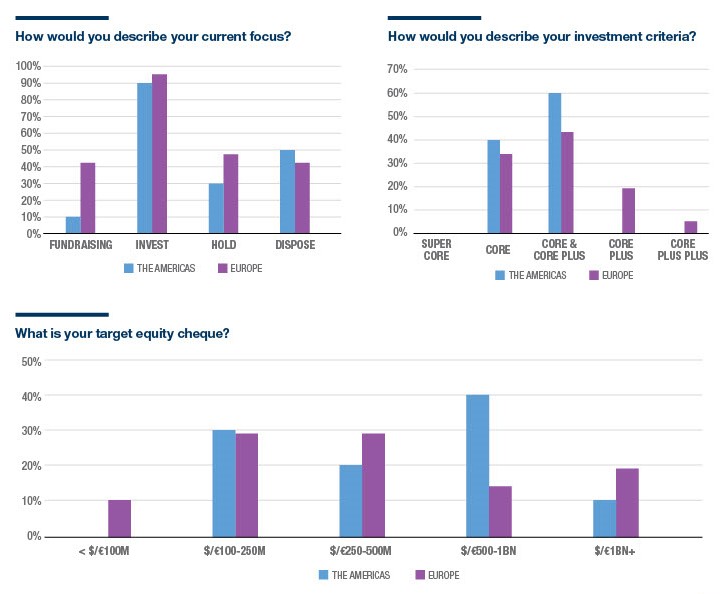

Member data from our latest six-monthly survey shows the current focus of investors in both the Americas (predominately the US) and Europe remains on asset investment, with the very large majority in both markets seeking to deploy capital (figure 1, top left). In Europe, the mood also leans towards fundraising and asset retention, whereas in the Americas, half of survey respondents are considering asset disposal as their current focus.

In terms of investment criteria (figure 1, top right), US investors are emphasising core and core-plus assets only. In Europe, while there is similar if slightly lower interest in these assets, investors are deploying core-plus or core-plus-plus strategies as well. This difference highlights the challenging market conditions that Europe has faced over the past 12 months and indicates a new reality that infrastructure investors face: the need to travel further up the risk curve to generate returns.

Looking at target equity cheques (figure 1, bottom), four out of 10 investors in the Americas are looking to deploy capital in the range of €500 million to €1 billion. Heading up the scale, the number of investors in Europe targeting deployments of more than €1 billion in capital is twice that of the US. This disparity highlights the European investors’ focus of replenishing cash reserves and channelling investments into assets.

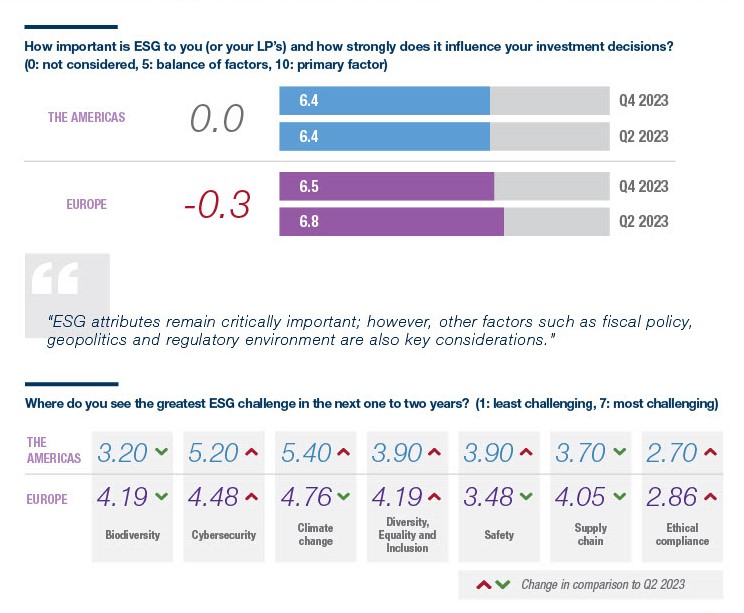

ESG considerations have evolved rapidly over the past year, with varying approaches on how these principles should be integrated into investment decisions. While Europe has generally charged ahead in integrating ESG into the investment process, there have been pushbacks against certain elements of ESG in the United States. Around 18 states have enacted anti-ESG legislation, with many others seeking to discourage these principles.

Despite these socio-political differences, however, there is little variation evident in the survey of the influence that ESG has in investment decisions (figure 2, top), or indeed change from our previous survey. European investors have dropped just marginally towards the US position.

But looking ahead over the next two years, investors do expect that a divergence in political will and regulatory approach will pose significant challenges (figure 2, bottom). The survey suggests that climate change, cybersecurity, biodiversity and supply chains will be key considerations in the EU. Whereas in the US, investors perceive climate change and cybersecurity as the more significant challenges, with safety and supply chains being smaller challenges compared to the EU.

Supply chain issues have decreased in both markets in the latest survey; this possibly indicates the impact of the Inflation Reduction Act which aims to on-shore specific industries and diversify supply chains to mitigate supply crises, as during the COVID-19 pandemic.

While ESG considerations are laden with political rhetoric and risk, its principles are widely employed and encouraged. The survey highlights this, with most European and American investors aiming to deploy €1-5 billion to achieve net zero across portfolios over the next five years (figure 3), and with notable increases in this size of equity deployment compared to the previous survey in Q2 2023.

In the US, the enthusiasm of investors looking to deploy €5-10 billion has declined since the early part of the year. This possibly reflects market slowdowns, the reality of new fundraising challenges, macroeconomic constraints and the Republican push to exclude ESG considerations from investment decision making.

Heading in the opposite direction, Europe has witnessed an increase in expectations of large-scale investments, with some investors slipping into the €10 billion-plus category compared to Q2. This could signify a regulatory framework offering more clarity to investors, and a unified approach and campaign encouraging the consideration of ESG factors within investment decision-making.