Breadcrumb

GIIA members increase investment in US, EU and UK core markets

Our latest insight work delves into the detail of the scale of GIIA members’ interests in the world’s three largest infrastructure investment markets: the United States, European Union and United Kingdom

It builds on our Global Asset Database 2022/23, first published in June, and assembles data on these core markets into three new ‘at a glance’ infographics that summarise the totals of member assets in each sector.

Overall, it is clear that member portfolios continue to increase in size and value. In the core markets of the US, EU and UK, GIIA members now collectively manage assets worth nearly $1.1 trillion, including very substantial allocations in the biggest markets:

- United States: $410 billion

- European Union: $386 billion

- United Kingdom: $278 billion

Added together, these three markets alone contain an impressive two-thirds (65%) of the worldwide total of $1.65 trillion of assets under management. The ‘top three’ have some 1,800 assets across 26 countries, with - in the case of the US - all 50 states being represented.

Total assets have risen by around 10% against the previous year, with 178 acquisitions across the US, EU and UK. Investment was most heavily focused on Europe in 2022, with 114 new assets compared to 60 in the United States, and with total assets owned in both markets rising compared to the previous year.

Renewable energy has been the standout sector for growth; while activity in telecoms, transport and utilities has declined, the last down by 25%. Notably, the growth in renewable energy acquisitions reflects remarkable fundraising efforts in the energy transition sector, accounting for 55% of all sector-specific fundraising in 2022.

Within the US, EU and UK markets, there has been greater emphasis on investments that are aligned with Environmental, Social, and Governance (ESG) principles. GIIA members with ESG-related funds acquired a total of 58 assets, of which 28 were acquired through Article 8 funds, 24 through Article 6 funds and 6 through Article 9 funds. Of these sustainability-related investments, 20 were related to clean energy while the remainder were distributed across telecoms, transport and utilities.

Total assets across ESG-designated funds in the UK, EU and US at the end of 2022 were:

- Article 6 funds: 256 assets

- Article 8 funds: 88 assets

- Article 9 funds: 18 assets

Investing in the United States

The US stands out as the region most invested in by GIIA members in 2022, with a quarter of the global total of AUM of $1.65 trillion. This is distributed across every state, with Texas and California seeing the most investment, and behind them New York, Illinois, Florida and Virginia which have all benefited equally from large amounts of GIIA member capital.

Members particularly channelled energy investments into LNG terminals, foreseeing a surge in demand. Out of the 60 member acquisitions in the US, 22 were closely linked to the energy sector, including 12 in renewables. Collectively, GIIA members contribute a remarkable 65 GW to the renewable energy capacity of the US, enough to power 15 million homes. These contributions both strengthen existing clean energy infrastructure and play a pivotal role in ensuring the future energy security of the US, as is evident through involvement in a 14GW green hydrogen pipeline.

The Inflation Reduction Act has undoubtedly enhanced the US’s appeal to international investors. However, there are still barriers to access grants and tax incentives. Further guidance from the Treasury Department and the Internal Revenue Service is essential to unlock investment in hydrogen and expedite the widespread deployment of solar energy.

Investing in the European Union

Rusia’s invasion of Ukraine in early 2022 and the ensuing energy price shock accelerated the need to diversify energy supplies and increased the pressure to deploy renewables at pace and scale. Among 31 new acquisitions in the renewable sector, 19 were dedicated to solar power, contributing an impressive 6.4 GW of capacity in larger European states such as Spain, France, Portugal and Germany.

Indeed, renewables represented the single most substantial sector in terms of investment volume, while the transport sector saw an influx of $75 billion in deal value, primarily driven by investments in road and toll road operators.

GIIA members also made substantial commitments to bolstering telecommunications infrastructure, deploying fibre connectivity in Germany, Spain, the Netherlands, France, Italy, Austria, Denmark and the Czech Republic. In 2022 our members added 120,000 kilometres of fibre to their networks, providing high-speed broadband to 20 million customers.

The telecoms sector maintained its momentum into 2023, with GIIA members recording a deal value of $29 billion and with a particular focus on towers and masts. This year, our members are poised to invest $12 billion in a greenfield project pipeline across Europe, enhancing the transport and energy sectors.

Investing in the United Kingdom

In 2022, GIIA members supported the UK's economic development across all regions. More than half (55%) of members' UK investments were channelled beyond London and the South, supporting the Government’s Levelling Up agenda with significant investment in Scotland, the North and Midlands, concentrated in sectors such as renewables and transport.

With members owning and managing around one-third of the nation's ports, their role in the economy is substantial. These ports handled around half of all UK port freight in 2022 (458m tonnes).

In addition, GIIA members have been instrumental in generating 61% of the UK's offshore wind energy capacity. More recently in autumn 2023, offshore wind auction rounds have received a lacklustre response, reflecting new challenges faced by investors and developers. These include higher interest rates, escalating material costs and rising labour expenses, which have become integral elements of an increasingly complex investment landscape. Left unaddressed, these could have adverse consequences on the UK’s effort to achieve net zero goals.

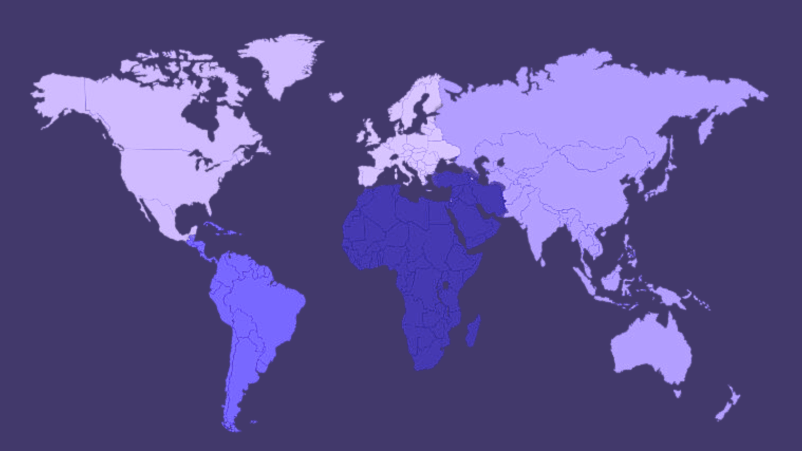

A global reach

This study looks primarily at the US, EU and UK markets, but the reach of GIIA members stretches right round the world. The global scale of assets under management is illustrated by this small selection of market statistics:

- 10% of global airport passenger traffic10% of global container trade

- 800,000 towers and masts – equivalent to a structure every 50 meters around the equator

- One third of global gas pipelines

- 10% of global datacentres

- 23m vehicles use GIIA member-owned roads daily – that’s 8.4 billion journeys per year

- EV charging networks spanning seven countries

- 200GW of renewable energy – enough to avoid the equivalent CO2 emissions of Spain