Breadcrumb

Charting a resilient course to net zero infrastructure

GIIA Head of Communications & Marketing Matt Dickinson reflects on key themes from this year’s GIIA Annual Conference

An unseasonably warm, rainy day during a COP27 summit where serious doubt was being cast on efforts to limit global warming to 1.5 degrees felt like a fitting backdrop for discussion of the big challenges and opportunities facing infrastructure investors.

So began our 2022 annual conference in London last week, where resilience and net zero were the overarching themes of this year’s meeting of infra leaders. And with good reason: the question of how to attain the latter whilst promoting the former is the greatest of our age.

With the latest COP policy resolutions underwhelming most commentators, the challenge of cutting harmful emissions, extracting carbon from the atmosphere, repairing biodiversity networks and promoting deep-seated resilience across transport, utility and comms networks will, it seems, increasingly fall to private investors.

The day’s agenda included a keynote address from National Infrastructure Commission Chair Sir John Armitt – in which he talked through the three pillars of the NIC’s next major assessment: climate resilience, net zero and levelling-up – as well as a fireside chat with Lord Mandelson, covering the geopolitical landscape for investors in the round and the state of UK politics heading into the next general election.

A range of expert panellists also offered their own unique takes on routes forward, with some key sub-themes resurfacing across discussions and talks:

Coordination

From governments and regulators to investors and operators, and from supply chains and manufacturers to communities and end users – unless everyone’s on the same page about climate change and resilience, progress will be stilted.

“A whole systems approach” is the only way forward, and whilst regulation around asset safety and maintenance has come a long way in countries like the UK, it remains lacking in many emerging markets, undermining global efforts to secure interconnected resilience worldwide.

Across individual portfolios, the need for strategies to address both physical resilience (informed by meticulous analysis) as well as financial resilience (to reduce risk of stranded assets and excessive leverage) are musts too, especially in response to unpredictable factors such as rising sea levels and extreme weather events, as well as geopolitical and economic shocks.

Some progress was made at COP27 on this front, with an agreement to facilitate global coordination around financing for net zero projects.

Regulation & certainty

After a tumultuous start to the decade, the need for stable, fair, predictable policy frameworks and regulation has never been greater.

The EU has of late served as an example of how an absence of certainty can impact investor sentiment: whilst deliberations around the decoupling of gas and electricity prices and revenue price caps have dragged on, investment in renewables has tumbled.

In the UK, chopping and changing on policy in recent months has been replaced by a tax regime that will hit renewable energy generators hard, threatening future investment, and a rowing back on plans to accelerate onshore wind delivery

The US, it seems, is now setting the standard in this area. Ambitious bipartisan infrastructure legislation has already spurred billions of dollars’ worth of new projects and, as one commentator put it in the wake of elections earlier this month:

“A few weeks ago, the investment bank Credit Suisse published a report saying that if the Inflation Reduction Act was implemented successfully, it could unleash more than $800 billion in spending and turn the U.S. into the world’s ‘leading energy provider.’ The midterm election was the great threat to that outcome. Now the threat has passed.”

“Ambition alone is worthless”

There’s no shortage of governments, companies and pressure groups talking the talk on resilience and net zero.

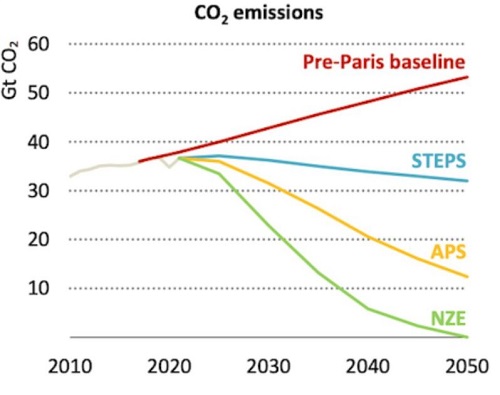

The forecasts below from the International Energy Agency, however, illustrate the current expanse that is the ‘ambition gap’ – the gulf in the chart between expected impacts of current government commitments (the Stated Policies Scenario, STEPs, in blue) additional plans for action (the Announced Pledges Scenario, APS, in yellow) and a net zero outcome (in green).

Even with all the positive talk, then, planned action – even in a best-case scenario – will not be enough to get the job done.

To take the EU as an example again, ambitious targets (such as 750 GW of renewable capacity by 2030) are not currently accompanied by detailed timelines for delivery.

As one speaker succinctly put it: “ambition alone is worthless”.

Curve balls

Whether on the upside or down, this year’s conference highlighted a number of hidden dimensions to net zero/ resilience challenge.

With regards to the water sector, for example, there are new avenues to explore around nature-based resilience solutions, floating solar capacity and energy from effluence.

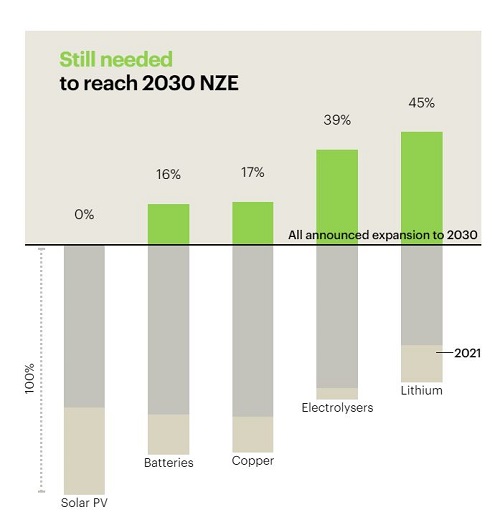

With regards to electrification, and the transition to new infrastructure models more widely, there’s a need to be mindful of dependence on finite resources such as lithium (reliance on which is highlighted in another IEA chart below).

How much is enough?

Attention soon turned to the question of cash: what level of resilience do consumers want, and how much are they prepared to invest to make it happen?

The energy transition, high performance and long-term resilience cannot be attained on the cheap, and an honest, constructive conversation needs to be had with stakeholders about the price of securing an inhabitable world for future generations.

Proper investment today, over increased costs to manage climate calamities tomorrow, is the way forward.

Dry powder & project pipelines

On the investment side, one contributor summarised what they saw as the two biggest barriers to delivery:

- Permitting and planning processes causing projects to become tied up in litigation (The EU is now looking to legislate for a maximum 18-month sign-off period for renewable projects)

- Global Inflationary pressures coupled with existing supply chain disruption – it’s increasingly expensive and logistically complex to mobilise project delivery materials

Without strong project pipelines, infrastructure investors are that much less able to deploy the estimated $300bn in dry powder they were holding as of last year.

Prioritisation

Another common sub-theme was how best to allocate resources to achieve goals swiftly.

Between carbon capture and storage, alternative fuels (including hydrogen), electrification, wind, solar, tidal, geothermal and biomass energy generation, as well as insulation, we now have numerous tools at our disposal to help us tackle the net zero challenge.

Tech as it relates to risk analysis, and upskilling and innovation within supply chains as they relate to clean investment, both emerged as priority areas.

On the nascent tech side, questions were raised about the level of government support needed to enable funds to dedicate resource to new innovations.

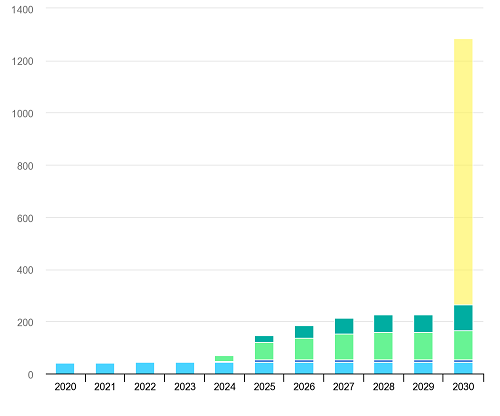

The question of ambition versus delivery loomed large in these conversations too – the IEA chart below illustrates operating/ under construction/ developing CCUS facilities globally in blue and green compared to the forecast capacity needed to attain net zero by 2030.

Making the case

One clear message to emerge at the close of the day was that investors can, and should, go further in vaunting the positives of private investment in infrastructure

More often than not, funds are deploying the collective pension pots of workers from across the private and public sectors to their benefit, and to the benefit of society as a whole.

Our research on the subject shows that close to 10 million pension pots in the UK alone are directly supporting and benefitting from infrastructure delivery.

Following the risk of collapse among some pension funds that were excessively exposed to government debt, UK policymakers now are looking at routes to greater diversification, including through long-term, stable infrastructure returns.

This week we launched a new partnership with ITN Business to give members a fantastic opportunity to showcase their latest innovations and success stories, as well as space to discuss the challenges they face.