Breadcrumb

Millions of UK pension savers supporting regional and national infrastructure

Analysis conducted by Global Infrastructure Investor Association (GIIA) has revealed the scale of ownership of infrastructure assets in the United Kingdom by pension savers.

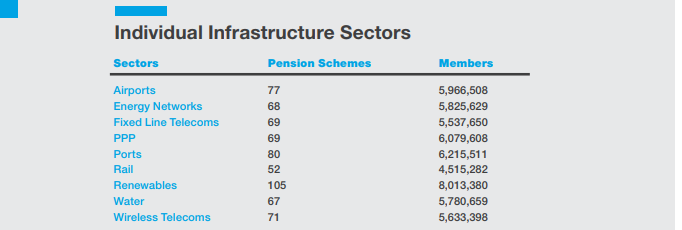

GIIA has identified more than 8,500,000 individual UK pension pots, from 118 UK pension funds, that have a financial interest in regional and national infrastructure including airports, utilities, telecoms and renewables.

The funds have a total combined value in excess of £100bn, demonstrating the massive investment in infrastructure made by UK citizens.

CEO Andy Rose, speaking on the release of the figures, said the information shed an important light on the debate around infrastructure ownership.

“This research reveals that millions of UK pension savers are benefitting from their investment in regional and national infrastructure.”

“The data shows that much of the UK’s infrastructure is part-owned by local authority, retail, manufacturing and other pension funds whose members have invested their savings in the expectation of satisfactory returns in their later years.”

“Not only are these individual investors securing their own retirement savings, they are also helping to deliver the high quality, innovative and sustainable infrastructure the United Kingdom needs for future generations.”